Binary options trading is rapidly gaining popularity Experienced traders and novice traders are both impressed by the simplicity of this new financial product and the exciting way to trade. Many brokers pay up to 85 percent on every successful “one choice or the other” trade which makes binary options one of the most lucrative investment products.

The basics of binary options trading are as simple as it gets: When you are investing in these options your are not actually purchasing an asset but you are betting on the way an underlying asset (gold, oil, currencies, stocks, …) is going to move. This makes this innovative investment instrument a very good opportunity for people already familiar with trading. However, the product itself is so easy to learn and simple to use that binary options are the best way for “newcomers” to start with as well.

IQOption Trading Platform

Trading Tip:

One of our top recommendations for binary options trading is IQOption. The company is one of the most experienced brokers when it comes to binaries.Apply Now!

Start trading with $10 only!

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

Binary Trading Online

A few years back, binary options were an instrument for professional traders and large financial institutions only. They were just traded in the OTC market (over the counter market) and not available for private investors.

There are now many binary options brokers online that are also for private investors. The best thing is that in contrast to a stocks trading account or a futures trading account, you don’t need a lot of money to get going. You can deposit as little as $100 (depending on the broker) to fund your account. This is another reason why this new investment product is your best choice to get started in the exciting world of binary trading.

How to trade Binary Options

Trading binary options is not difficult. The nature of the product makes it very easy to understand. Here is a short and simple guide to understand the simple process:

According to the name binary, there are just two possible outcomes of a trade: When the option expires, it can be “in the money” or “out of the money” – you win or you lose. If you are able to predict the right direction of the underlying asset’s price and the option closes “in the money”, you will gain up to +85% in return. Otherwise, you will lose your investment. These are the simple rules of binary options trading.

When buying a binary option, there are only a few elementary steps you have to go through. The most basic concept goes as follows:

- choose an underlying asset and the expiry time of the option

- choose the amount you are willing to risk

- choose the direction of the underlying asset’s price you are betting on (up = call, down = put)

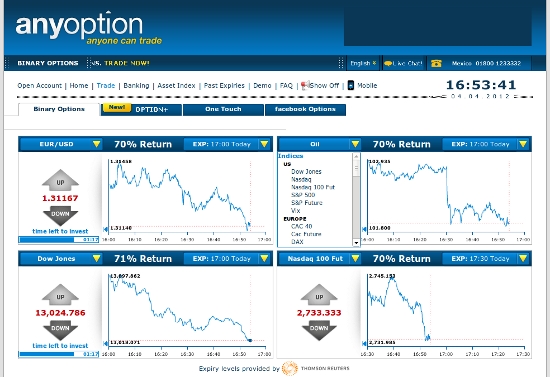

Binary Options Trading at AnyOption

At first you have to decide which underlying asset class you would like to go with. Most brokers offer many different assets like currency pairs, stocks and indices, gold, oil and many more. You choose the expiry time of the option which can be as little as 60 seconds up to one month depending on your broker. Enter the amount you would like to bet on the price movement and finally you have to decide if the price will go up or down. Click the “Buy Option” button and you are done – you are in the market now!

Underlying Assets in Binary Options Trading

When trading binary options you don’t actually purchase an asset but you bet on the price movement of an underlying asset. All brokers offer a very wide variety of underlying assets to bet on. This includes currency pairs, commodities, indices and stocks.

Forex Options: When trading the Forex market with binary options you can invest in all major USD currency pairs like EURUSD, GBPUSD, USDCHF, USDJPY, AUDUSD and USDCAD. Many brokers offer additional cross currency pairs like EURGBP or EURJPY.

Commoditiy Options: Most experienced traders include commodities in their trading strategies. When the economy is on shaky ground, usually the first place for investors to look for a safe heaven is the market in precious metals. With binary options, you can bet on gold and silver as well as the price movement of oil.

Stock Options: However, if you prefer individual stocks this option is possible too. Binary stock options trading includes major brands like IBM, EXXON, McDonalds, Sony, Microsoft, Google, Amex, Coca Cola, Apple, Nike, Amazon, BP, CITIGROUP and many more.

Index Options: Most of the time, stock indices are easier to trade than individual stocks. The reason for this is that an index includes and averages the price of many stocks. Therefore, you are diversified automatically. Binary options brokers allow you to bet on underlying futures like the Dow Jones, Nasdaq, S&P 500, Dax 30, Nikkei, SMI and many more.

Binary Options Trading Basics

Trading binary options is very uncomplicated and even new traders can learn the basics very quickly. If you are new to trading the technical terminology is probably the first thing you have to overcome. Therefore, getting familiar with the trading language should be your first goal. Here are the basics:

Strike Price: Both, the investor and the market maker agree on a certain price level (strike price) the underlying asset of the option has to breach before the binary option itself will have a positive payout.

Expiration: Binary options expire at a certain point of time at which the contract between the investor and the market maker is terminated. At this point the current price of the underlying asset is compared to the strike price to determine if the binary option is “in the money” or “out of the money”.

In the Money: The strike price level of the underlying asset is broken. As a result, the binary option itself is currently “in the money” and will result in a positive return at expiration as long as the price stays above (call option) or below (put option) the strike price.

Out of the Money: The strike price level isn’t broken and the binary option is “out of the money”. If the price doesn’t break the level until expiration the bet will be lost.

Up/Down Options – High/Low Options: This is the most common product every binary options broker has in place. You can choose if the price of the underlying asset will close higher or lower on expiration. If you believe that the price of the underlying asset will go up you have to buy a binary call option. A binary call option is a contract that rewards the investor if the price closes above the strike price. By contrast, a binary put option is a contract that rewards the trader if the price of the underlying asset closes below the strike price. A binary put option is the opposite of a binary call option.

Touch Binary Options: You have to decide if the price of the underlying asset is going to hit a certain target price before the expiry time. If you think that a certain price level will be broken before expiration you can buy a touch up option or a touch down option depending on the direction of your predicted price movement. If you think the price won’t breach a certain price level you can go with a no touch option.

Range/Boundary Binary Options: These type of options have a lower and an upper target price. You have to decide if the option expires within the range between these two targets or outside the range.